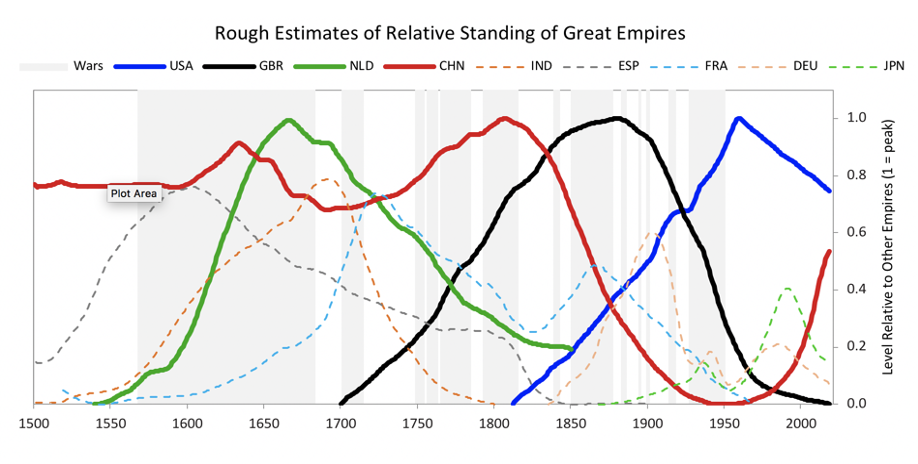

Looking at Bridgewater’s very long-term cycles analysis, the Speaker notes that it would be a mistake to bet America’s future will be like its glorious past. These cycles have occurred for as long as history has been written.

In the first stage, countries are poor and think that they are poor. In the second stage, countries are rich but still think they are poor. In the third stage, countries are rich and think of themselves as rich. And in the fourth stage, countries become poorer and still think of themselves as rich. This encapsulates the US experience during the 2000’s.

This is the leveraging up phase—debts rise relative to incomes until they can’t anymore. The psychological shift behind this leveraging up occurs because the people who lived through the first two stages have died off or become irrelevant and those whose behavior matters most are used to living well and not worrying about the pain of not having enough money. Because their spending continues to be strong, they continue to appear rich, even though their balance sheets deteriorate. The reduced level of efficient investments in infrastructure, capital goods, and R&D slow their productivity gains. Their cities and infrastructures become older and less efficient than those in the two earlier stages. Their balance of payments position deteriorates, reflecting their reduced competitiveness. They increasingly rely on their reputations rather than on their competitiveness to fund their deficits. They typically spend a lot of money on the military at this stage, sometimes very large amounts because of wars, in order to protect their global interests. Often, though not always, at the advanced stages of this phase, countries run twin deficits. In the last few years of this stage, bubbles frequently occur.

The Speaker worries that the US is now in the fifth and final stage of a sovereign’s life cycle, in which countries go through deleveraging and relative decline, which they are slow to accept.

After bubbles burst and when deleveragings occur, private debt growth, private sector spending, asset values and net worths decline in a self-reinforcing negative cycle. To compensate, government debt growth, government deficits and central bank “printing” of money typically increase. In this way, their central banks and governments cut real interest rates and increase nominal GDP growth so that it is comfortably above nominal interest rates in order to ease debt burdens. As a result of these low real interest rates, weak currencies and poor economic conditions, their debt and equity assets are poor performing and increasingly these countries have to compete with less expensive countries that are in the earlier stages of development (Ed note: Based on Bridgewater’s framework, China is currently in the second stage). Their currencies depreciate and they like it. As an extension of these economic and financial trends, countries in this stage see their power in the world decline.

Source: Bridgewater

By seeking to withdraw into “Fortress America,” the Trump White House has accelerated the decline in this final stage as the US has come to question the very worth of its mantle of global leadership. This presents a pertinent question, for how long can America reap the rewards of empire if it no longer wants to be an empire? It was agreed the 2020 election and future presidents will not be able to reverse or change this trajectory.

The UK’s pound sterling lost nearly a quarter of demand as the global reserve currency between 1899 and 1913 as the British empire retrenched. Sterling’s share of world reserves still accounted for about 50% until 1950, but then declined to about 5% over the next 30 years. Financial markets move faster today.

In the 15th and 16th centuries, China accounted for 25 to 30 percent of the global economy but it fell below 5 percent by the 1950s after the destruction of World War II and under the rule of Mao Zedong. Today its economy makes up about 17% of the global economy—roughly the same as the US, which has seen its share decline from 27 percent in 1950.

It was noted China is leading the 5G race and the US can do little about it. In recent news, Boris Johnson defied President Trump’s threats and backed Chinese telecom firm Huawei to play a critical part in the build out of UK’s 5G infrastructure. China is looking to the future while America suffers from crumbling infrastructure, lower levels of educational attainment, unfunded entitlements, fractious politics, and growing levels of societal inequality.

A participant noted that this will be China’s century, echoing Ray Dalio: “Would you have not wanted to invest with the Dutch in the Dutch empire? Would you have not wanted to invest in the industrial revolution and the British empire? Would you not want to invest in the United States and the United States empire? I think it’s comparable.”

The contrary viewpoint to this argument is that the US has something China doesn’t—the laws are clear, publicized, and stable; are applied evenly; and protect fundamental rights, including the security of persons and contract, property, and human rights. The processes by which the laws are enacted, administered, and enforced are accessible, fair, and efficient. This implies the world may continue to invest in US assets, even if China rises in dominance.

What could change this, of course, is if the dollar begins a steep decline. While the fundamental reasons for this are evident, no one was confident around the timing. There was frustration that currencies have been so placid.

Photo: Pexels