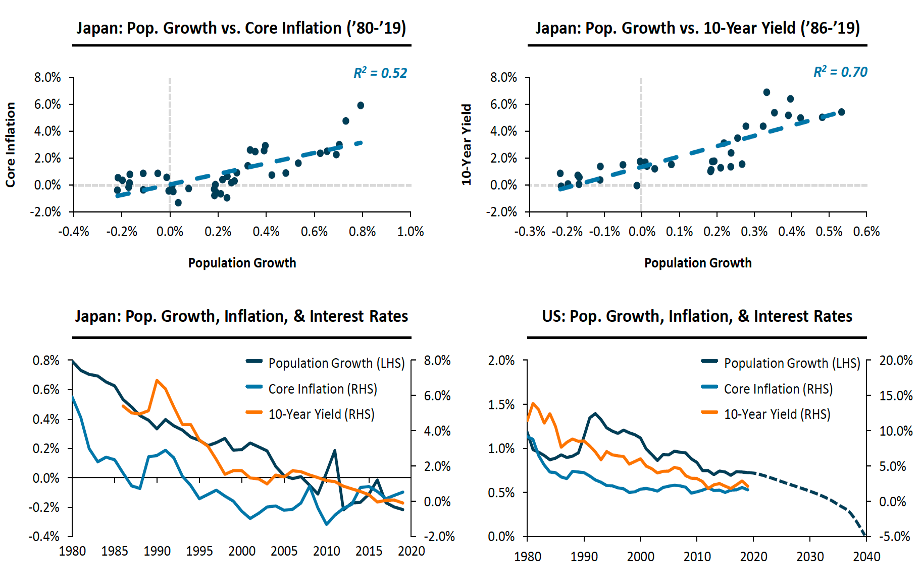

Slowing population growth can be a headwind for inflation and help explain why interest rates have remained stubbornly weak in some places. Studying the implication of demographics on inflation and interest rates in Japan, the Speaker, who runs one of the most successful TMT long/short equity funds, shares his macroeconomic assessment that US interest rates are going even lower—and thus equity valuations can be even higher.

Equity valuations appear high, unless measured against richly priced global sovereign debt markets. The earnings yield on US equities (the inverse of the P/E ratio) is 260 basis points above the 10-year bond yield. In 1999, the earnings yield was well below the bond yield.

Source: METI, Japan Ministry of Finance, Census Bureau, OECD, Bureau of Economic Analysis, US Treasury, Light Street Estimates

The Speaker said that the ongoing multiple expansion is sustainable and that we are in a melt-up phase with significant upside still. “The low level of nominal bond yields provides an important offset to the richness of earnings multiples.” He thinks US interest rates can be negative in a few years’ time. A macro investor sitting beside him disagreed. “Central banks are giving up on negative interest rates. The regime is in its final act.”

Another participant noted that the New York Fed just published a paper titled, “Managing the Treasury Yield Curve in the 1940s.” That is certainly more likely in the US in the future. Fed Vice Chair Clarida supports this, and Japan has implemented its own yield-curve-control policy.

But there was pushback on the Speaker’s other comparison between Japan and the US. Japan’s population hit a peak in 2008 said a participant, and the decline is accelerating despite record immigration. US population is still growing by 0.7 percent a year and net immigration remains positive. Japan is also the world’s largest creditor while the US is the world’s largest debtor. Unlike Japan, the US is reliant on foreign savings to fund its deficit, which means there could be more upward pressure on US interest rates.

It was not clear to anyone what could eventually break this dynamic of low yields, which, in turn, would short-circuit the relentless rise in multiples apart from the rise of Senator Sanders as the potential frontrunner in the Democratic nomination. The Speaker agreed, “The market would fall 30 percent if he gets elected and none of this would matter.”

There were no strong views on the US election, although our host said that Bloomberg will win in November as a matter of factly. Then he paused, “Maybe that’s just my dream!” We all burst out laughing.

Photo: Shutterstock