We shared a telling analogy in July. The US shale boom and Silicon Valley were both profitless technological revolutions funded by cheap capital and carrying enormous benefits to society. The main point was that sequencing matters when a boom turns into a bust.

By examining the shale experience from 2010 to 2020, we pinpointed three stages: the first focuses exclusively on growth; the second, when things go south, is marked by capital discipline; and the third is defined by the distribution of free cash flow to shareholders.

When companies are seen to be making progress in the second stage the market rewards them with higher share prices. Many stocks can double, even if this amounts to a countertrend rally. We see evidence of this beginning to take form in tech.

“Meta needs to get fit and focused,” wrote Brad Gerstner, founder and CEO of Altimeter Capital, in an October 24 open letter to Mark Zuckerberg. “Like many other companies in a zero-rate world, Meta has drifted into the land of excess—too many people, too many ideas, too little urgency. This is obscured when growth is easy but deadly when growth slows and technology changes.”

To double free cash flow to $40 billion annually, Gerstner recommends cutting headcount by at least 20 percent (which would only return the company to employee expense levels of mid-2021), reducing annual capex by at least $5 billion (leaving it still at $25 billion versus annual capex of $15 billion in 2018, 2019 and 2020), and limiting investment in the metaverse to no more than $5 billion per year.

Source: Business Insider

“It is a poorly kept secret in Silicon Valley that companies ranging from Google to Meta to Twitter to Uber could achieve similar levels of revenue with far fewer people,” Gerstner argued. “These incredible companies would run even better and more efficiently without the layers and lethargy that comes with this extreme rate of employee expansion.”

Meta more than doubled its staff since the pandemic began. It is now laying off 13 percent of its workers as well as cutting spending to become a leaner and more efficient company. Zuckerberg admitted getting carried away with enormous growth during covid and considerably boosted investments. “I got this wrong,” he said, “and I take responsibility for that.”

Even the cautious CEO of Stripe, Patrick Collison, acknowledged that the company overhired during the pandemic. It is now firing 14 percent of its workforce. Collison blamed “stubborn inflation, energy shocks, higher interest rates, reduced investment budgets and sparser startup funding.”

Amazon is cutting ten thousand jobs, the largest layoffs in the company’s history in order to streamline operations amid slowing sales growth and economic uncertainty. Longtime employees told Bloomberg that the last few months’ cost-cutting was the most severe they’d ever experienced.

Elon Musk, Twitter’s new owner, is showing how to combat corporate bloat. He emailed an ultimatum: commit to “working long hours at high intensity” or resign. He’s expected to lay off half of the social media giant’s staff in an effort to place Twitter on a “healthy path.” For all the controversy he has caused, he is illuminating the way forward.

Source: Tech Crunch

Uber reported positive free cash flow of $382 million for the second quarter after CEO Dara Khosrowshahi pledged to be “hardcore about costs across the board.” The stock popped on the news and is trading 35 percent higher than its June low. But the ride-hailing and food delivery giant is still a long way from being in a position to return cash to its shareholders.

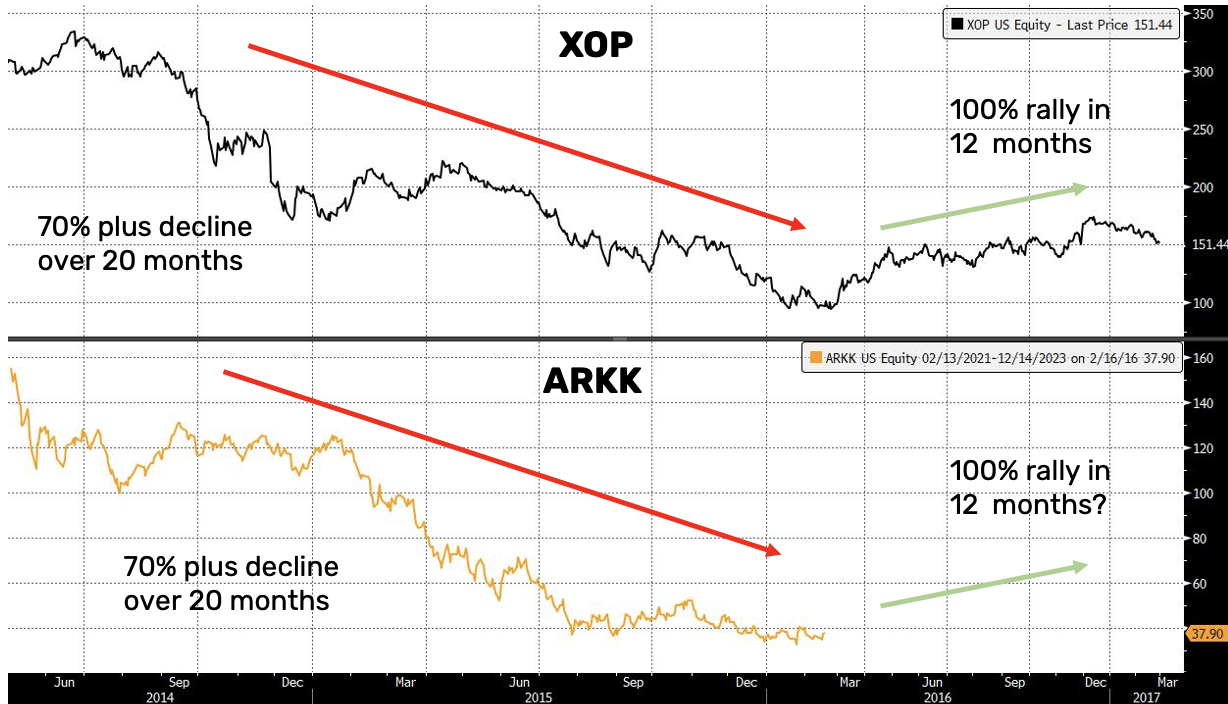

To jog your memory about the order in which the boom–bust cycle unfolds, the energy stocks grouped into the S&P 500 Oil & Gas Exploration and Production ETF (XOP) plunged 73 percent from mid-2014 to early-2016 when oil prices crashed only to be followed by a 100 percent gain in twelve months as shale companies laid off workers and cut spending. Then, however, it dropped another 83 percent to the March 2020 low. The road to generating meaningful free cash flow is a difficult and protracted one.

The analogy we draw is with Cathie Wood’s Ark Innovation Fund (ARKK). Since February 2021 it has declined 79 percent. In this second stage, we anticipate ARKK will double in value to around $60 a share before declining 75 percent to its final low later in the decade. Do you understand what this means?

Only in an environment where the S&P 500 is up at least 25 percent can ARKK be up 100 percent. That would put the S&P 500 at a new record high above 5,000.

Source: Bloomberg